Trusted Mortgage Broker Glendale CA: Obtain the Best Offers on Home Loans

Trusted Mortgage Broker Glendale CA: Obtain the Best Offers on Home Loans

Blog Article

The Thorough Duty of a Home Loan Broker in Safeguarding the very best Lending Options and Prices for Your Home Purchase

A home mortgage broker offers as a crucial intermediary in the home purchasing process, linking customers with an array of lenders to secure ideal loan alternatives and prices. By examining specific monetary conditions and leveraging market understandings, brokers are well-positioned to work out positive terms and simplify the commonly intricate lending application process.

Recognizing the Home loan Broker's Duty

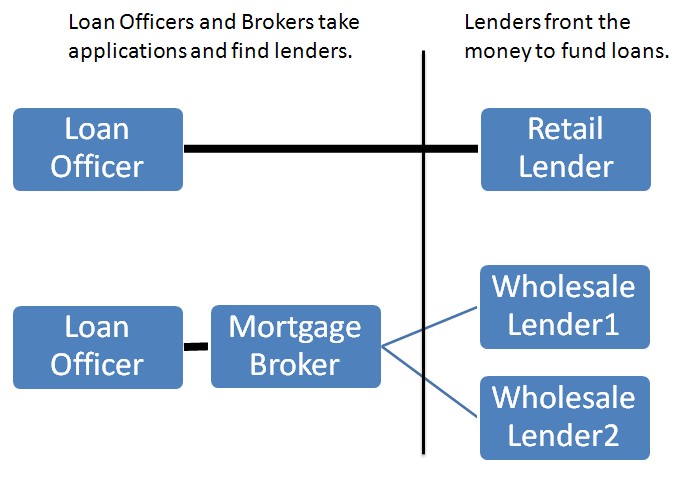

Home mortgage brokers often serve as middlemans between loan providers and debtors, promoting the lending acquisition process. Their primary obligation is to evaluate the economic requirements of clients and match them with ideal home mortgage items from a series of loan provider. Mortgage Broker Glendale CA. This needs a thorough understanding of the home mortgage landscape, consisting of numerous funding kinds, rates of interest, and lender requirements

Brokers begin by gathering necessary economic info from clients, such as earnings, credit rating, and existing debts. This information is vital for identifying one of the most appropriate financing alternatives offered. When the needed information is gathered, brokers conduct comprehensive market research to determine lenders that align with the borrower's requirements, typically leveraging well established relationships with several banks to secure affordable terms.

Additionally, home loan brokers give assistance throughout the entire loan application procedure. They assist customers in finishing paperwork, guaranteeing compliance with lending institution demands, and offering guidance on improving credit reliability if needed. By serving as a bridge in between debtors and lending institutions, mortgage brokers simplify the often-complex procedure of safeguarding a home loan, inevitably conserving customers time and effort while boosting the likelihood of safeguarding beneficial car loan terms.

Benefits of Utilizing a Mortgage Broker

Additionally, home mortgage brokers have accessibility to a broad selection of loan provider, which allows them to existing borrowers with a wide variety of options that they may not discover separately. This access can cause extra affordable rates and terms, inevitably saving consumers money over the life of the lending.

One more advantage is the time-saving aspect of dealing with a broker. They deal with the complicated documents and settlements, simplifying the application process and reducing the worry on borrowers. Additionally, brokers can provide individualized support and recommendations throughout the financing journey, fostering a feeling of self-confidence and clarity.

How Home Loan Brokers Contrast Lenders

Brokers play a pivotal function in contrasting lending institutions to determine one of the most ideal options for their clients. They possess extensive expertise of the home mortgage market, including different loan providers' prices, products, and terms - Mortgage Broker Glendale CA. This experience allows them to conduct extensive analyses of the available loan alternatives based upon the special economic scenarios and choices of their customers

Home loan brokers use specialized tools and databases to gather current information from this source on multiple loan providers efficiently. They analyze essential factors such as rate of interest, loan charges, payment terms, and eligibility requirements. By comparing these components, brokers can highlight the benefits and drawbacks of each alternative, guaranteeing their clients make informed decisions.

Additionally, brokers preserve connections with a varied series of loan providers, consisting of typical banks, credit unions, and alternate funding sources. This network allows them accessibility to unique deals and possibly better terms that might not be readily available directly to customers.

Inevitably, a home mortgage broker's capability to compare lending institutions equips clients to secure affordable prices and beneficial financing problems, streamlining the procedure of locating the best home loan service tailored to their private needs.

The Funding Application Refine

Browsing the financing application process is an important action for clients seeking to safeguard financing for their homes. This process generally starts with the collection of needed documentation, including earnings confirmation, debt reports, and possession declarations. A home loan broker plays a vital role right here, assisting clients through the documentation and guaranteeing all details is precise and full.

When the documentation is collected, the broker submits the loan application to multiple loan providers, facilitating a competitive setting that can result in far better terms and rates. They additionally aid clients comprehend various financing alternatives, such as fixed-rate, adjustable-rate, or government-backed lendings, ensuring the selected product straightens with their monetary scenario.

Throughout the underwriting process, which includes our website lending institutions assessing the debtor's credit reliability and the residential or commercial property's value, the broker serves as an intermediary. They communicate updates and attend to any kind of extra demands from the loan provider, streamlining the procedure for you can find out more clients. This assistance is critical in reducing stress and complication, eventually accelerating the authorization timeline. By leveraging their experience and industry relationships, mortgage brokers improve the likelihood of an effective car loan application, enabling clients to move closer to homeownership with confidence.

Tips for Selecting the Right Broker

Picking the best home loan broker can substantially affect the general loan experience and outcome for customers. To guarantee an effective partnership, think about the adhering to ideas when choosing a broker.

First, evaluate their experience and online reputation within the sector. Try to find brokers with a tested record in securing desirable lending terms for clients with differing financial profiles. Mortgage Broker Glendale CA. Checking out reviews and looking for referrals from trusted sources can supply important insights

Second, examine their variety of loan provider links. A broker with accessibility to several loan providers will be much better positioned to provide varied funding options and affordable prices, ensuring you locate the very best suitable for your demands.

Third, ask about their communication style and accessibility. A responsive broker who prioritizes client interaction can aid alleviate stress throughout the funding procedure.

Finally, guarantee they are transparent about their charges and settlement structure. A credible broker will certainly offer a clear malfunction of expenses in advance, helping you prevent unforeseen expenditures later.

Verdict

By leveraging market expertise and discussing desirable terms, brokers boost the likelihood of securing optimal lending options and rates. Selecting the best home mortgage broker can lead to a more effective and effective home acquiring experience, eventually contributing to educated economic decision-making.

A home loan broker serves as an important intermediary in the home buying procedure, linking purchasers with a range of loan providers to protect optimal lending options and rates.Home mortgage brokers often act as middlemans between consumers and lending institutions, facilitating the finance procurement procedure.In addition, home mortgage brokers offer guidance throughout the whole car loan application process. By serving as a bridge in between consumers and lending institutions, home loan brokers streamline the often-complex process of securing a mortgage, eventually conserving clients time and initiative while raising the chance of safeguarding positive loan terms.

By leveraging their know-how and market relationships, home mortgage brokers improve the chance of an effective finance application, making it possible for clients to move more detailed to homeownership with self-confidence.

Report this page